I’ve rewritten this post three times, and with each rewrite, I’ve gotten more angry. It started as a post about how the Republican Party hasn’t won the women’s vote in a presidential election since 1988. It changed into an observation that legislation is often used to reward supporters rather than to help the country as a whole. This final iteration has morphed again into an accusation that the Republican Party uses practices which raise barriers to Americans who are more likely to vote democratic.

In this blog, I generally try to report facts without taking a side. Today, however, I state quite emphatically that the practices employed by republican elected officials to restrict voter turnout are harming the country.

Whichever political party is not in power spends a lot of time trying to convince voters that things are bad and it’s the other party’s fault. Things will only improve, the argument goes, if the balance of power shifts to their party after the next election. The voters buy the argument much of the time and major structural changes have become entrenched.

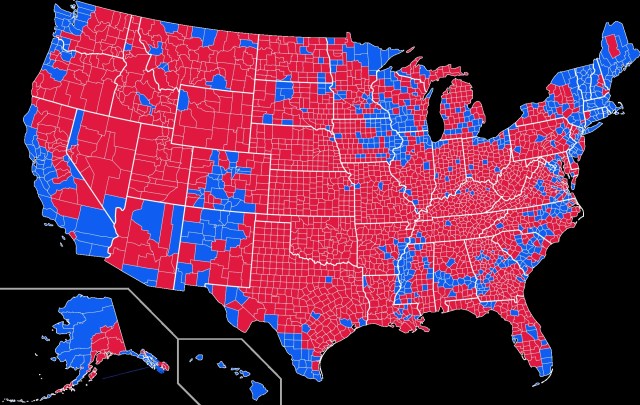

After the 2012 presidential election, one defiant conservative pundit attempted to discount Obama’s large electoral college victory by showing a map of the vote broken down by county and claiming that the country is overwhelmingly republican. Someone else on the program said that it looks like democrats like water. Check out the map for yourself.

That “democrats like water” statement was an interesting observation. Water has been a life-sustaining consideration ever since we humans began roaming the planet. Water is needed for many things, but cities grew near rivers, lakes and oceans because they facilitate trade. So as you look at those county election maps, notice that the democratic areas (blue) are the more populated ones. Cities tend to vote democratic, while rural areas tend to vote republican.

Is the country “overwhelmingly republican?” Yes, by area. No, by population. So what makes the United States a country – its people or its land? Both, of course, but should government programs meant to improve things in the country be concerned with improving the lives of all citizens or just the lives of the people who own the most land? I vote for the former – government should work to improve the lives of the greatest number of Americans possible.

Some republicans, on the other hand, looked at these election maps and came up with a strategy. While cities tend to vote democratic, suburbs are up for grabs. Many of the people who live in suburbs moved out of the cities in a search for low crime neighborhoods, better schools, lower taxes and more living space. With a very high percentage of rural districts voting republican and a substantial number of suburban districts doing the same, governors and state legislative bodies in many states are controlled by republicans. This is true even for states which are majority democratic.

With republicans in control of state government, they were able to reshape (gerrymander) the U.S. House of Representatives districts in many states to ensure a republican majority to the House. Not only do you end up with a republican majority, the effect of gerrymandering is that many of the republicans are on the political far right and many of the democrats are on the far left. Compromise is almost impossible in such a legislative body.

Here we are with a republican led House and Senate and a democratic president. The republicans would like to control both the legislative and executive branches after the next election. What’s the next step in this battle?

Let’s look at how Obama won the last two elections? In 2012, Obama won 51% of the popular vote compared to Romney’s 48%, but he won 62% of the electoral college vote. The states allocate electoral college “electors” on a winner-takes-all formula based on the state’s popular vote.

Michigan legislative leaders have suggested changing the system to award electors based on the majority vote in each congressional district. For a state like Michigan, this would likely provide more republican candidate Electoral College electors than democratic, even if the state popular vote is several percentage points higher for the democratic candidate. Other states would see similar results in such a system.

And this highlights a popular republican strategy. Through gerrymandered districts, voter identification laws, reduced polling stations and curtailed early voting opportunities, many state republican leaders attempt to disenfranchise the voters who are more likely to vote democratic. Whenever a barrier can be utilized to reduce minority and low income voter participation, the republican candidate has a better chance of winning.

So for at least a couple decades, the republican strategy has been one of exclusion. The national candidates make speeches in which they state that they are a party of inclusion, but the actions of many republicans indicate the opposite is true.

The primary system is largely at fault. In order to win the nomination in this ever more polarized country, the candidates have to blame America’s problems on the very groups that the national leaders say are welcome in the party. These contrasting messages aren’t working very well for republicans, so they double down on the exclusion policies. The latest shot in Michigan – disallow straight party voting because the data show republicans are more likely than democratic voters to make selections for the judges and state boards of education candidates that are at the bottom of the ballot.

So whom have the republicans attempted to disenfranchise?

1. Lower income individuals by requiring driver’s licenses or state id’s for people without cars;

2. People who work multiple part-time jobs (also low income) by reducing polling locations and hours;

3. People who move often (again, low income) by making it difficult to vote if their current address is different than that shown on their identification;

4. People in larger cities (all social classes, but generally lean liberal as a group) by attempts to overweight the power of rural districts, when viewed from a population standpoint.

There is another demographic which should cause concern for the republicans: women. A republican presidential candidate has not won the women’s vote since 1988, and Obama beat Romney by 11% four years ago. Just how will the republicans attempt to disenfranchise women? Here are a few options.

1. Change polling places to locations that are unpopular with women – perhaps smoke-filled cigar shops and gentleman’s clubs;

2. Put up “No Children” signs at polling places (won’t get them all, but it would knock down the numbers);

3. Hire drunk men to hang around near the entrances to polling places (probably backfire – I assume lower income women have to deal with these situations more often than upper income women).

Those suggestions are obviously tongue-in-cheek, but this situation is making me pretty annoyed.

This republican strategy of disenfranchisement means that they design their economic and social policies in a manner that helps the wealthy, the farmer and rancher, the landlord and business owner, but harms the people who do not typically vote for them. Donald Trump has expanded the republican appeal to the middle and lower middle class because of his promises of a return of America’s greatness, but I don’t believe most of these people would be pleased with the probable effects of his policies.

If the Republican Party adopted policies which would benefit the entire country, they would not need to have a strategy of exclusion. If they could prove themselves with results, the voters would flock to them, regardless of race, religion or class, and I would be one of them.

The general public doesn’t have a good idea of how the overall economy is doing; they just know what they see and hear. They see that there are more jobs locally, but perhaps the jobs are not of the same quality as they or their friends lost in the Great Recession. Maybe the local jobs are good, but they hear from conservative radio, television and presidential candidates that the country is in bad shape. Okay, the local jobs are good and the national jobs numbers are good, but the conservatives are saying that Obama is ruining the country with high deficits.

The media can shape the voters’ beliefs and the conservative voices speak more often and with more emphasis. Some of them genuinely believe that the country will be better off if taxes and regulations are cut dramatically so domestic business will flourish. Others, I suspect, are just stating the party line. The policies they propose benefit the wealthy much more than it helps the general public.

Let’s look at the results of republican policies. The George W. Bush era tax cuts and the wars in Iraq and Afghanistan have resulted in trillions added to the national debt, a bank-led housing bubble, and the resultant crash that brought misery to millions of Americans during the recession. Those tax cuts have also led to unprecedented wealth and income inequality in this country. The republicans have blamed the budget deficits on President Obama, but if you look closely at the annual federal income and outlays, the problems predated his administration.

Who is the American voter to believe? Why not me?

Tax cuts for the wealthy do not stimulate the economy, they just stimulate savings (economic research presented in previous posts). Some of that savings is in the form of real estate and high rent is the negative impact on low and middle income people. Affordable housing is becoming a major problem in cities and there is increasing homelessness because families cannot afford to live close to the available jobs.

What policies are more likely to work?

1. Simplify the individual tax code in a way to cut loopholes, deductions, credits and tax rates, but do not raise taxes on lower income individuals because that slows the economy and reduces jobs;

2. Build in tax incentives to promote business investment and eliminate tax incentives for the wealthy to save their money;

3. Simplify the business tax code so companies are willing to repatriate overseas earnings and are not tempted to change their corporate offices to other countries to reduce taxes;

4. Support social safety net programs, including childcare, that help those in need return to the workforce;

5. Means test social security benefits so they go to those in need, and not those who don’t (this is scary because retired people vote, but they’re still not likely to vote democratic);

6. Support health care programs so people have a measure of security (many republicans say they want to replace Obamacare; let’s hear their plans);

7. Rein in excessive spending (including some of the expensive parts of the farm bill such as crop insurance).

As with the retired, farmers and ranchers are not likely to vote for democrats.

Although the republican presidential candidates spend a lot of time telling the voters how horrible things are in the country, things are actually pretty good. There has been steady job growth, the dollar is strong, interest rates are low, tax revenues are increasing, and the 2015 deficit is lower than the deficit during most of the G.W. Bush years.

We are not in a bubble. We don’t want to be in a bubble because things seem great for a year or two, but many people are hurt and recovery is slow when bubbles burst. We want steady, boring, predictable growth and live within our means. The boom and bust cycle is a unfortunate way to run a country (or a business or a family, for that matter). I’m all for this steady improvement.

I watched last night’s Syracuse-UNC mens basketball game with a conservative friend and when the game got a little lopsided, we talked politics a little. Well, he talked a little – I may have spoken excitedly for a while.

On a conservative radio show, he heard about runaway federal government job growth and salary increases. The show’s host implied that we’re approaching a tipping point. Soon, he says, there will be so many people working for the federal government, or related to someone who does, that Big Government policies will dominate and the country will be doomed.

It’s simply not true. In late 2011, Congress and the President couldn’t agree on a way to cut spending and/or increase revenue to reduce the deficit. They came up with a poison pill idea called sequestration. If they were unable to come up with an agreement by the end of 2012, substantial across-the-board spending cuts would go into effect at the beginning of 2013 for social programs and military spending. It didn’t work – our government took the poison pill.

Because of sequestration, the federal government has been shrinking, not growing, but I have no doubt that the conservative host found a rare example and exaggerated it to the whole government. Fiscal year 2015 spending is higher than that in 2011, but 2012-2014 all had lower spending. At the end of 2015, Congress approved a huge package of tax cuts and spending increases which are reflected in the 2015 numbers. With representatives like these, who needs enemies.

I attempted to get tax help from the IRS this past week. Once I finally reached an agent, I was told that, due to budget cuts my question was “outside the scope” of what the IRS can address. Think about that. Congress has reduced the budget for the IRS, but has also made the tax code so complicated that many people have no choice but to spend hundreds of dollars on professional tax advice. There’s something wrong with this system.

Well, now I’m just ranting. Let’s fix congress – I’m not sure how, but they need to change the way they do business. Let’s allow every citizen of legal age to vote, not put up barriers which make voting difficult so the congressman can stay in power and reward his/her friends and supporters. Let’s look at economic research to develop the best policies for long term growth in the country. Let’s do something!!!

No wonder my friends think I sound like a Trump supporter. I’m angry enough and I think Congress is the problem. I’ll write about a lighter topic next time.